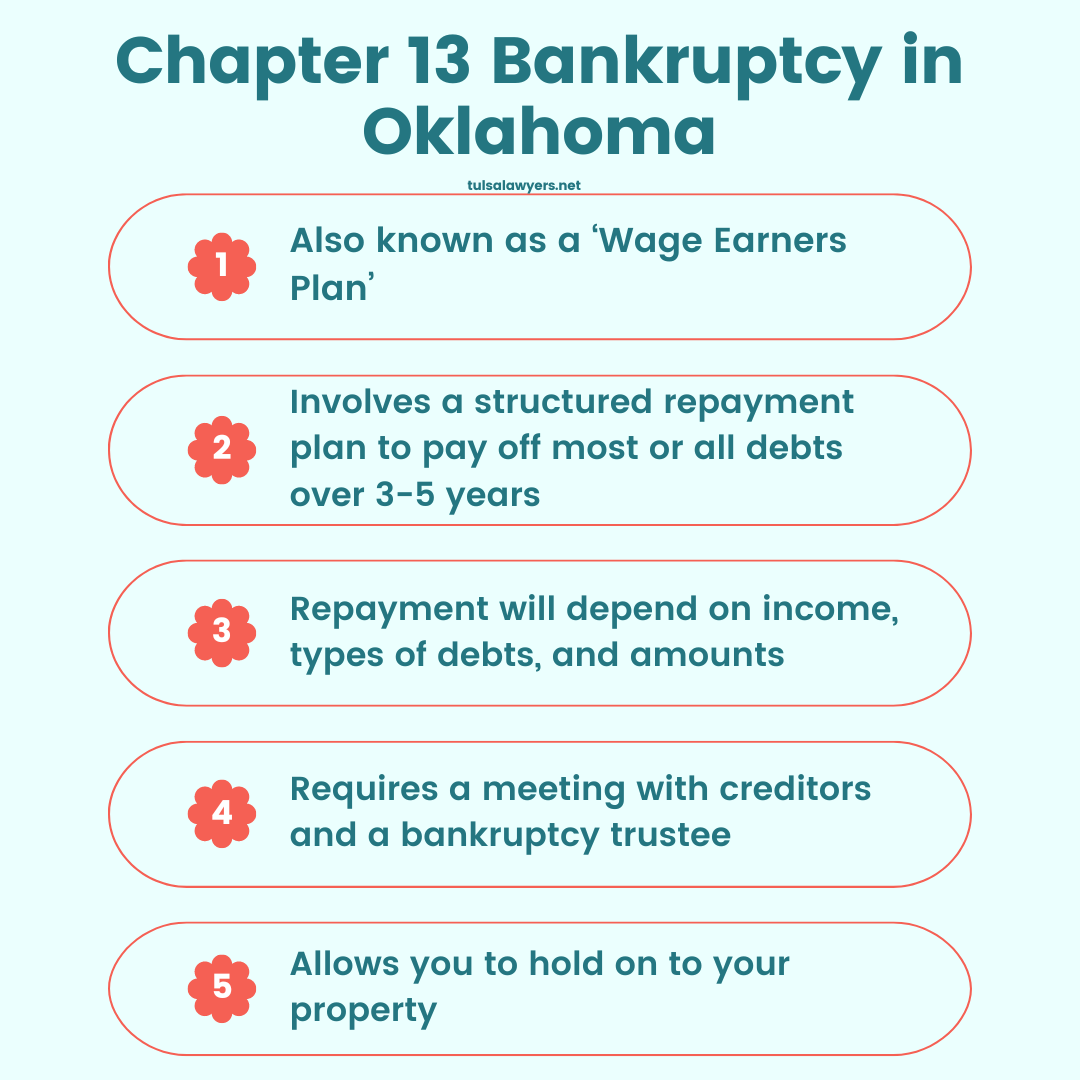

If you’re facing financial challenges, you might have heard about Chapter 13 bankruptcy as a potential solution. This type of bankruptcy, known as a wage earner’s plan, allows you to create a plan to repay your debts. By restructuring your debts into a more manageable repayment schedule, Chapter 13 bankruptcy provides a pathway to financial recovery and stability while allowing you to retain assets such as your home or car. Understanding how Chapter 13 bankruptcy works can help you decide if it’s the right choice for your financial situation. For other important legal information, check out our Tulsa Law Blog.

How Chapter 13 Bankruptcy Works in Oklahoma

Chapter 13 bankruptcy is designed for individuals with a regular income who can pay back their debts through a structured repayment plan. Unlike Chapter 7 bankruptcy, which can lead to the sale of your assets to pay debts, Chapter 13 focuses on debt adjustment and enables you to hold on to your property. You propose a repayment plan that explains how you will pay creditors over 3-5 years. The amount you must repay depends on your income, the amount you owe, and the types of debt you have.

Eligibility for Chapter 13 Bankruptcy

To qualify, your unsecured debts (such as credit card bills and medical expenses) must be less than $419,275. Your secured debts (like mortgages and car loans) must also be less than $1,257,850. These amounts change periodically to reflect changes in the consumer price index. Additionally, you must prove that you have filed state and federal income tax returns for the past four years.

The Process of Filing for Chapter 13 Bankruptcy

Filing for Chapter 13 bankruptcy starts with submitting a petition to the bankruptcy court serving your area. Along with your petition, you need to file schedules of assets and liabilities, a schedule of current income and expenditures, a schedule of executory contracts and unexpired leases, and a statement of financial affairs. You also need to submit a copy of your most recent tax return and a proposed repayment plan. A fee is necessary to file the petition, but in some cases, you can pay it in installments.

The Role of the Bankruptcy Trustee

Once you file your petition, the court appoints a bankruptcy trustee. This trustee evaluates your financial situation and serves as the intermediary in negotiations with creditors. In addition, the trustee plays a role in overseeing the implementation of your repayment plan, as well as ensuring that all parties properly follow its terms and timelines. This entails collecting payments from you through the agreed-upon schedule and disbursing these funds to your creditors in accordance with your repayment plan.

Meeting of Creditors

After filing for Chapter 13, a meeting of creditors will take place. During this meeting, creditors can ask questions about your financial situation and proposed repayment plan, which you answer under oath. The trustee will also review your proposed repayment plan and evaluate the feasibility of the plan. By doing this, they are ensuring it complies with bankruptcy laws, as well as protects the interests of the creditors by potentially raising objections to the plan if it fails to meet certain standards.

The Repayment Plan

Your repayment plan is the core of your Chapter 13 bankruptcy. It explains how much you will pay each creditor. Priority debts, such as taxes and the costs of bankruptcy proceedings, must be paid in full, while unsecured debts, like credit card debts, might not be fully repaid. Your plan must allocate your projected disposable income to debt repayment over the plan period. Your repayment plan will need approval by the court before it will go into effect. During the confirmation hearing, the court looks at whether the plan meets the Bankruptcy Code’s requirements and whether it was made in good faith. Creditors can object to the plan if they believe they are being treated unfairly.

Living with Chapter 13 Bankruptcy

Once your repayment plan gets approval, you must make regular payments to the trustee to ensure that your creditors will receive the money that you owe them. While on your repayment plan, it’s important to stick to your budget and avoid incurring new debts. If you fail to meet the payment requirements outlined, your bankruptcy case may be subject to dismissal. Alternatively, your bankruptcy could be converted to a Chapter 7 bankruptcy, which involves liquidating assets to satisfy creditors, as opposed to allowing you to keep your assets while working to repay debts over time.

Discharge in Chapter 13 Bankruptcy

After completing all payments under the plan, you receive a discharge of most of your remaining debts. However, there are exceptions to this discharge. Some types of debts, including some tax obligations, student loans, and mandates by family court are not eligible for discharge under Chapter 13 bankruptcy laws. The discharge legally absolves you from any further responsibility for the debts listed in your repayment plan.

Tulsa Bankruptcy Lawyer

Chapter 13 bankruptcy can be a valuable tool if you’re seeking to reorganize your finances and manage your debts responsibly. It offers a way to keep assets while working on your debt, provided you can comply with the repayment plan. Understanding these aspects of Chapter 13 can help you make an informed decision about how to address your financial challenges. The best way to understand these aspects is to talk with a Tulsa bankruptcy lawyer. They can guide you through the process to ensure your plan is solid. If you’re looking for help, contact Tulsa County Lawyers Group by calling (918) 379-4864 or contacting us online for a consultation with an attorney.